Whether you should become an https://www.bookstime.com/ depends on many factors, including the type of business, the plans for the business and the short- and long-term goals of the owners. Learn about S corporations, both their advantages and disadvantages, including asset protection, taxation, payments, ease of conversion, qualification requirements and more. A limited liability company is a corporate structure in the United States wherein the company members are not personally liable for the company’s debts or liabilities.

“Some bookkeepings may want to convert to C corporations.” Accessed May 13, 2020. “How S-Corp and Other ‘Pass-Through’ Income is Taxed and the Effects of Proposed Tax Reforms.” Accessed May 13, 2020.

Hailing from Tucson, Arizona, Nate moved to Golden, Colorado, in high school where he played soccer. He went to S Corporation the University of Colorado at Boulder and enjoyed business classes like accounting, finance and marketing.

In addition, income and losses need to be allocated according to the percentage of ownership, unlike a LLC or partnership where the allocation can be different by setting it up in the operating agreement. An S Corporation has high credibility among potential vendors, customers and partners, as an S Corporation is a recognized business structure. Both corporations and LLCs must register to do business in states outside of the home state. Because it is a corporation, an S corporation is required to allocate profits and losses among the owners based strictly on the percentage of ownership or number of shares held. In contrast, an LLC is able to allocate its profits and losses in whatever proportions the owners desire.

Car purchased in company name, S Corp will depreciate the vehicle but my question is can the S Corp deduct the mileage and depreciation? Not both, no. On an individual return, (Form 1040), claiming the standard mileage deduction is a provision that is allowed to simplify claims of vehicle expenses.

For example, pass-through taxation generally is positive because it results in less taxation. But if a business goal is to accumulate money for expansion—perhaps to build a new facility—a C corporation could be the better choice because income can be retained within the corporation.

She has always wanted to be in a field where she can help people accomplish their goals and make their dreams reality. She wants our clients to view her as a part retained earnings of the team that will make that happen. Her current goal is to earn her Enrolled Agent certification to help clients navigate everything, including their taxes.

She graduated from Widefield High School just a short time ago (ha!). While in school she focused on Business / Administrative Assistant and started working at Exchange National Bank part time while in High School.

In many states, owners pay annual report fees, a franchise tax, and other miscellaneous fees. However, the charges are typically inexpensive and may be deducted as a cost of doing business. Also, all investors receive dividend and distribution rights, regardless of whether the investors have voting rights. S corporation shareholders must be individuals, specific trusts and estates, or certain tax-exempt organizations.

Stephanie joined our team at the peak of tax season in 2018 upon returning back to her native Colorado Springs after a 3 year stint in North Carolina. Emily grew up in Arizona and has been in Colorado for over 12 years now.

She has a love of numbers and was drawn to the tax preparation a few years ago. She is currently working on her Master’s of Science in Accounting. Chelsea grew up in Marlborough, Connecticut, staying busy with Girl Scouts, dancing, sports and arts and crafts. Both of her parents were small business owners, which is where her fascination with accounting and business began. In college, Kate studied post-production in film school, but in her early 20’s, accounting called and she has never looked back.

In her personal life, Terry loves to spend time with her husband (a retired warrant officer – served 25 years!) and her son, who graduated from CU Boulder and works in the marketing field. Her daughter currently attends SDSU and is working toward becoming a nurse. Terry feels online bookkeeping blessed to be in beautiful Colorado, close to so many family and friends. She also enjoys running, watching HGTV and playing the occasional round of golf. Terry has spent her career in public accounting, which she loves because she gets to meet so many wonderful people.

After her mom stepped back from the business, Roberta took it over and successfully ran it for more than 10 years. She merged with WCG to help her clients get more consultations and planning. Roberta specializes in contract accounting, QuickBooks and casualty losses. She was inspired to focus on casualty losses due to many people around her being affected by the Black Forest Fire in 2013.

She is a Tax Senior, which allows her to prepare various types of tax returns, tax projections and help review returns. Rachael Weber has earned both a Bachelor of Arts in Accounting and a Bachelor of Science in Psychology (there’s a joke about accountants being crazy in there somewhere!). She has been preparing tax returns for over 20 years and has previously worked in compilations and audits. Cherri has lived in the Colorado Springs Area all her life.

She meet Jason and other wonderful employees, and found out that this company was the place she wanted to be (we are super happy she found that out too)! I have many years of administrative experience and look forward to many more at WCG.

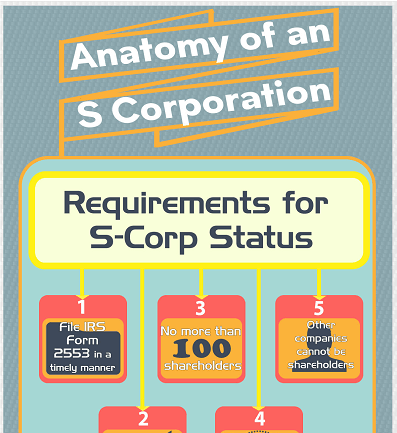

With a background in taxation and financial consulting, Alia Nikolakopulos has over a decade of experience resolving tax and finance issues. She is an IRS Enrolled Agent and has been a writer for these topics since 2010. Nikolakopulos is pursuing Bachelor of Science in accounting at the Metropolitan https://www.bookstime.com/articles/s-corporation State University of Denver. Businesses seeking S classification must file IRS Form 2553, which includes six pages of instructions and four pages of data entry. After the IRS processes the form, you receive a letter confirming the business’s election to seek S classification.

Passive activity includes any rental activity except for those covered by the special rules applied to taxpayers in real property business as provided for in Section 469(c) of the code. by Miriam Nicole Huffman S corporations are penalized when they accumulate excessive passive income. Santiago Norte has been preparing tax returns for over nine years, and doesn’t plan to stop anytime soon! He has even worked overseas in Germany, preparing tax returns for the military and expatriate populations, which has helped develop his passion for unique tax situations.